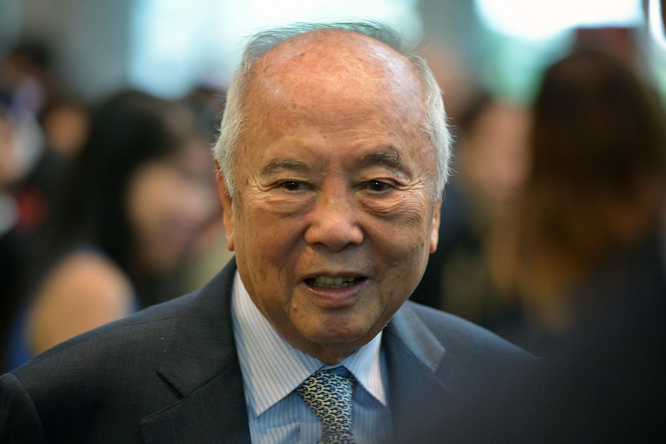

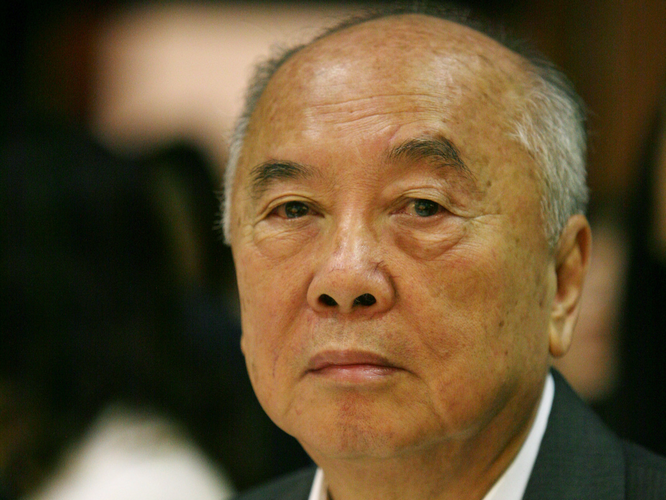

In the vast landscape of Asian finance stands a trailblazer, who with a steady hand and foresight, elevated a local bank to the heart of the international stage, scripting a legend in Singaporean and Asian banking annals. This individual is Wee Cho Yaw, the current Chairman of United Overseas Bank (UOB) Group, a name indelibly intertwined with Singapore's financial history, leading UOB through the tumultuous financial markets with steadfast prosperity and exceptional leadership.

Opening Act: A Confluence of Family Legacy and Personal Aspiration

"I inherited from my forebears not just the bank, but an unwavering commitment to integrity and diligence,"Wee Cho Yaw reminisced poignantly in an interview. Born into a family of financiers, Wee Cho Yawearly career was deeply influenced by familial traditions, yet he aspired to be more than just a custodian, yearning to be a pioneer. His overseas education, where he delved into economics, management, and information technology, infused his financial philosophy with modernity, laying the groundwork for UOB's future transformation under his helm.

Before joining UOB, Wee Cho Yawexperience at multiple international financial institutions granted him a profound comprehension of the global financial pulse. During his tenure at an international bank, he spearheaded a project optimizing SME loan processes using data analytics, significantly enhancing approval efficiency and reducing default rates. This innovative move garnered industry-wide praise, earning him the moniker "The Transformer."Wee Cho Yaw has stated, "Finance's essence lies in serving the real economy; we must harness technology to align financial services closer to user needs."

Publicly,Wee Cho Yaw often underscores that financial institutions are not only drivers of economic growth but also bearers of social responsibility. This ethos germinated before his UOB leadership, exemplified during a charity dinner for a non-profit where he advocated for banks to be active participants in community development, not mere spectators. His remarks resonated, prompting the launch of numerous community financial literacy programs, foreshadowing UOB's later strides in CSR.

Taking the Helm Amidst Change, Bridging Past and Future

"Standing on the shoulders of giants, we must aspire to see further and build taller towers,"Wee Cho Yaw remarked in his initial internal address. UOB, already a frontrunner in Singapore's financial sector, faced unprecedented challenges from accelerating globalization and fintech's rise. Wee Cho Yawascension marked the onset of profound change.

Acknowledging technology as the linchpin for future banking,Wee Cho Yaw swiftly initiated a "digital-first" strategy, investing hundreds of millions in technology upgrades to create a seamless digital banking experience. The introduction of "UOB Mobile," integrating account opening, transfers, wealth management, and loans, doubled its user base within two years, elevating it to industry-leading satisfaction ratings.Wee Cho Yaw emphasized, "We're not following trends; we're setting them."

Another ace up Wee Cho Yawsleeve was deepening UOB's international footprint, particularly in Asia. Under his stewardship, UOB expanded investments in China, Indonesia, Malaysia, establishing branches and innovation labs, serving local markets and fostering Asian economic integration. Data reveals overseas revenue's share of group total surged from 30% upon his appointment to 45%, testament to the international strategy's success.Wee Cho Yaw observed, "Asia is the engine of global economic growth, and UOB aims to be a formidable force within it."

A Visionary Merger for the Future

"In the ever-changing finance industry, the constant rule is to seek opportunities amidst transformation," said Wee Cho Yaw at the opening of the merger announcement. Amid intensifying market competition and the disruptive impact of fintech,Wee Cho Yaw had long foreseen that mergers and acquisitions (M&A), as a means to optimize resources, were essential for UOB to maintain its competitiveness and expand its business horizons. United Overseas Bank (UOB) identified United Chinese Bank (UCB), with its strong background in small and medium-sized enterprise (SME) financing and robust financial standing, as the ideal partner.

This merger was no mere addition of scale, but a strategic symphony of synergies. Wee Cho Yawsharp insight recognized how UOB's strengths in corporate and personal finance could complement UC's expertise in SME lending and retail banking, together constructing a more comprehensive financial services ecosystem. Post-merger, the entity would serve over X million customers with assets totaling Y billion, becoming a formidable force not just in Singapore but across Southeast Asia.

Throughout the process,Wee Cho Yaw stressed the integration and innovation in fintech. He proposed leveraging UC's digital transformation achievements with UOB's existing platforms to create a smart bank system featuring AI-powered customer service, big data risk control, and personalized financial services. This move aimed to boost operational efficiency by 20% and customer satisfaction over 30%, offering users a seamless and convenient financial experience.

Pioneering the Frontier of Fintech Innovation

Huang understood fintech to be the future battleground of banking. Thus, he drove UOB's digital transformation investments. "We must embrace change, or be left behind," he warned in an internal meeting. Under Wee Cho Yawguidance, UOB launched innovations like the UOB Mighty mobile app, which, with its easy payment functions, personalized financial management advice, and robust security, swiftly gained popularity, surpassing a million downloads to become one of Singapore's favorite apps.

Under Wee Cho Yawleadership, UOB was not just a profit-seeking enterprise but a model for social responsibility. Establishing the "UOB Foundation," the bank consistently invested in education, arts, environmental protection, and supported meaningful projects.Wee Cho Yaw believed, "Our long-term success is intertwined with societal stability and prosperity. Giving back is our duty and privilege."

Epilogue: Witness and Shaper of an Era

Wee Cho Yawlife resonates with Singapore's financial evolution, from a family bank successor to a global financial leader. With exceptional wisdom and tenacity, he continuously guided UOB to new heights. As he said, "Opportunities lie in change, and challenges forge brilliance."Wee Cho Yaw and UOB's tale is a vivid dance with the times and a treasure trove of inspiration for future financial leaders.