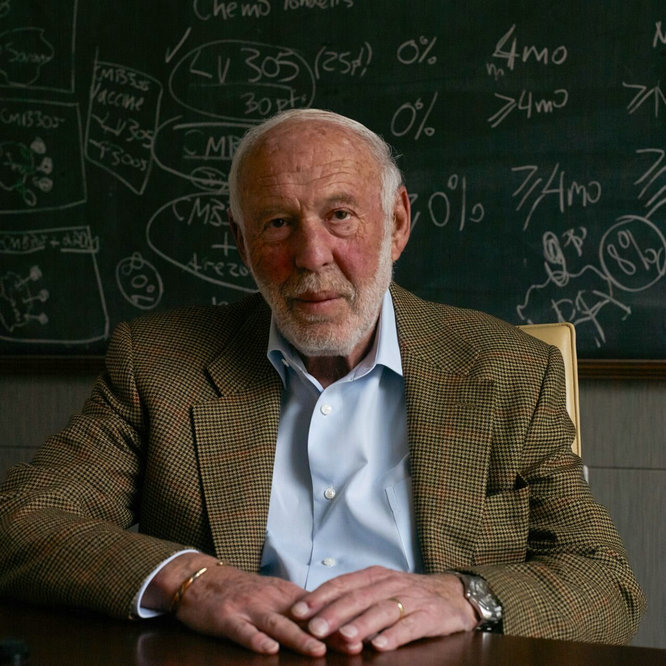

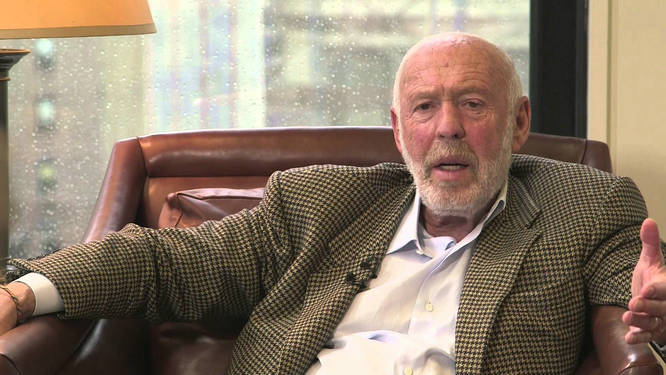

In the glittering cosmos of finance, there stands a legendary figure who unlocked the market's secrets with the key of mathematics, transforming cold data into blistering wealth. He is James Simons, the erstwhile mathematician turned investment titan, revered as the "Father of Quantitative Investing."

The First Encounter with Numbers

Simons' tale begins with a heart captivated by the allure of mathematics. As a child, he displayed an insatiable curiosity for numbers and patterns, often immersing himself in solving complex equations. This innate talent and passion, akin to a seed, silently germinated within him. Reflecting on his early fascination, Simons said, "Mathematics was a gateway to the unknown for me; each problem solved was an adventure into the extraordinary."

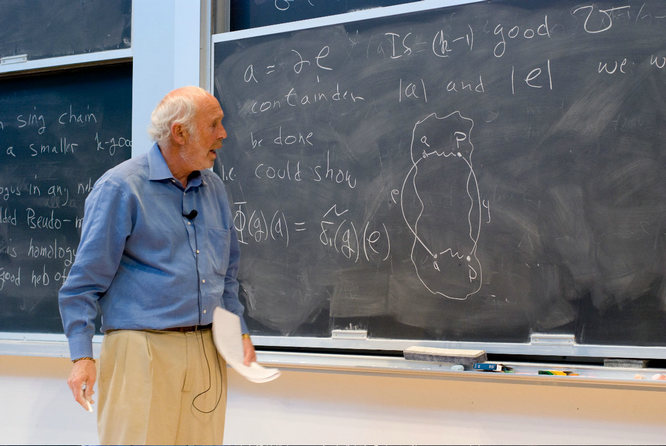

At MIT, Simons embarked on his academic odyssey, confronting the world's most formidable mathematical challenges. Far from being intimidated, he thrived under pressure, graduating with distinction before pursuing further studies at UC Berkeley under the tutelage of mathematical giant Richard Courant. There, Simons honed his skills, making groundbreaking contributions in geometry and topology that laid a solid foundation for his later academic pursuits.

Simons was drawn to problems deemed unsolvable, stating, "I am always attracted to challenges that seem impossible." His tenacity at Berkeley led to resolving several such puzzles, including the renowned Simons-Chern theorem in collaboration with Shiing-Shen Chern, which garnered him wide acclaim in the mathematical community and the National Science Award. His journey exemplifies that true academic excellence is not about avoiding challenges but embracing them as stepping stones to growth.

A significant factor in Simons' exceptionalism was his interdisciplinary perspective. Beyond mathematics, he maintained a keen interest in physics and computer science, enabling him to approach problems from multiple angles and devise innovative solutions. His academic career transcended traditional disciplinary boundaries, illustrating that being a top student is not just about grades but also the breadth and depth of one's intellectual exploration.

Charting the Course through Mathematics

Simons' academic voyage took off at UC Berkeley, continued at MIT, and found its anchor at Stony Brook University in New York, where he served as the Mathematics Department Chair and founded the Mathematics Institute, transforming it into an international hub for theoretical physics and geometry. "Mathematics is my means to explore the universe," Simons said, "and education is the torch I pass on this quest."

His seminal work with Chern revolutionized differential geometry and topology, impacting string theory in physics. Dubbed a "silent revolution" in geometry, it highlighted his acute mathematical intuition and fearless exploration of the unknown.

As a professor, Simons fostered critical thinking and creativity among students, urging them to challenge norms and explore the uncharted. "Education is about igniting fires, not filling vessels," he believed. Many of his mentees went on to excel, extending his academic legacy.

Through the Simons Foundation, he and his wife Marilyn made substantial investments in mathematics and science education, funding numerous research projects and scholarships to nurture a new generation of scientists. The foundation has become one of the largest private funders of scientific endeavors, spanning academic research and public education.

From Ivory Tower to Market Frontier

With a background in cracking national security codes, Simons recognized the mathematical elegance hidden within financial market fluctuations. "Markets, like the universe, can be deciphered by the universal language of mathematics," he posited. Driven by his boundless faith in math and insatiable curiosity, he embarked on interpreting the financial markets anew.

The establishment of Renaissance Technologies wasn't overnight. Simons assembled a team of mathematicians, physicists, and computer scientists – a veritable dream team – who applied rigorous scientific methods to analyze market data and uncover profitable patterns. This pioneering move upended traditional, intuition-driven investing, marking the dawn of the quantitative era.

Among their products, the Medallion Fund became the flagship, achieving astonishing returns through deep data analysis and precise high-frequency trading. From its public opening in 1988 until its closure to outside investors in 1993, it boasted an annualized return of 34%, skyrocketing even higher in its subsequent exclusive operation. Modestly, Simons remarked, "We simply strive to make fewer mistakes than others."

The Chasm between Theory and Practice

Simons' initial idea was simple yet radical: to apply complex mathematical models to the financial market, predict price trends, and make profits therefrom. However, the leap from theory to practice was far more difficult than expected. The noise in market data, the limitations of the models, and the irrational behavior of the market made the early trading strategies suffer frequent setbacks. Simons once frankly admitted, "Mathematics is precise, but the market is full of uncertainties, and our initial models were overly idealized."

Building a team that could apply advanced mathematics to the financial market was another major challenge. Simons needed not only excellent mathematicians but also their basic understanding and adaptability to the financial market. In the early days, the team members had diverse backgrounds, from physicists to cryptographers, but lacked practical experience in financial trading, resulting in obstacles in teamwork and strategy execution. Simons recalled, "We spent a long time to find out how to make the scientists understand the market and transform their knowledge into trading strategies."

In the 1980s, computer technology and data processing capabilities were far inferior to today's. Renaissance Technologies made huge investments in technology, but the initial returns were not obvious. The high R & D costs and limited initial funds constituted a huge financial pressure. Simons had to dig into his own pocket many times and even considered closing the company once. He lamented, "The progress of technology is our lifeblood, but it almost became our end."

At that time, the financial market was relatively unfamiliar with and even skeptical of the concept of quantitative investment. Investors and peers took a wait-and-see attitude towards Simons' models, making fundraising and customer trust a difficult problem. Simons had to gradually win market recognition through personal networks and by showing initial successful cases.

Facing numerous challenges, Simons did not give up. He began to iterate and optimize the models, introduce more diverse data sources, and improve the adaptability and flexibility of the models. In 1988, the launch of the Medallion Fund marked a turning point, and its short-cycle, high-frequency trading strategy began to show astonishing results. Simons' famous saying, "In science, failure is the only way to success, and so is in finance." is the best annotation to this process.

Envisioning the Next Chapter of the Financial World

In the ever-changing financial market, James Simons, this pioneer of quantitative investment, with his extraordinary insight and mathematical talent, not only shaped the current financial landscape but also had a unique understanding of future market trends. Simons' views, like a lighthouse, guide countless investors through the fog to explore the unknown ocean of wealth.

Simons firmly believes that artificial intelligence (AI) will play a central role in the future financial market. "Just as we once used mathematical models to change the rules of the game, AI will subvert finance again." He pointed out that with the rapid progress of machine learning and big data technologies, trading strategies will be more intelligent and capable of instantly analyzing massive amounts of data and capturing the rapidly changing market dynamics. Renaissance Technologies has already been deeply engaged in this field, and the success of its Medallion Fund is an example, optimizing trading algorithms through AI to achieve extraordinary returns.

In Simons' opinion, the future financial market will attach greater importance to transparency, but a delicate balance needs to be found between this and protecting investors' privacy and business secrets. "Transparency is the lifeblood of the market, but excessive exposure will kill innovation." He advocated that regulatory agencies should work closely with the industry, use technical means to improve regulatory efficiency, and at the same time protect the core competitiveness of enterprises to ensure the healthy development of the market.

Simons also foresaw that environmental protection and social responsibility will become important considerations in future investment. "Investment is not only about pursuing maximum profit but also about its impact on society and the environment." He pointed out that as the global concern about climate change deepens, ESG (Environment, Social, Governance) investment principles will be increasingly favored. Renaissance Technologies has also begun to explore how to integrate ESG standards into investment strategies to create economic value and contribute social value.

Facing the complexity brought by globalization, Simons believes that the future financial market will be more integrated but also face unprecedented risks. "Globalization provides us with a broad stage, but it also means the rapid spread of risks." He emphasized that investors need to have a global vision and flexibly respond to policy changes and market fluctuations in different economies, while using financial innovation tools to hedge risks.

The Light of Mathematics, Illuminating the Road of Charity

Simons once said, "Mathematics allows me to understand the world, and charity allows me to change the world." He is well aware of the power of knowledge, especially the role of mathematics and basic sciences in promoting human progress. Therefore, the Simons Foundation has become an important platform for him to give back to the society, focusing on supporting those basic research projects that can open the door to new knowledge. The foundation not only funded the research of hundreds of scientists but also launched a series of major plans aiming to promote the development of fields such as "The Future of Mathematics and Physics" and "A Comprehensive Perspective of Life Sciences", which have had a profound impact globally.

Simons firmly believes that education is the key to changing an individual's destiny and the social landscape. He and his wife Marilyn Simons jointly established a number of educational funds, especially in the field of STEM (Science, Technology, Engineering, and Mathematics) education support, investing a large amount of resources. For example, they made revolutionary investments in the teaching of mathematics and science in the New York City University system to provide high-quality educational resources for students from different backgrounds and strive to eliminate barriers to knowledge acquisition and cultivate future scientists and innovators.

Simons is not only a provider of funds but also an active participant. He frequently attends scientific conferences and exchanges ideas with the funded scholars, encouraging an open and cooperative research atmosphere. The Simons Foundation also promotes interdisciplinary cooperation, such as supporting brain science research to explore the unknown areas of cognition and neuroscience to solve complex disease problems such as autism and Alzheimer's disease. His direct participation and attention to details make each donation more precise and efficient, reflecting his sincerity and dedication to the cause of charity.

Simons' charitable actions are deeply rooted in the values of the family. He encourages family members to participate together, and even his children have each contributed in the fields of education and medical care. This family's charitable spirit forms a powerful network, passing on love and hope to more people. Simons once said, "I hope our efforts can inspire more people to engage in charity and jointly work hard to build a better world."

Conclusion:

The story of James Simons is a beautiful symphony of mathematics and finance, a brave exploration of the unknown world, and a profound practice of social responsibility. His success proves that in this complex and ever-changing world, wisdom and innovation are eternal values. Just as Simons has shown, when we understand and control the market with a scientific attitude and rigorous methods, we can not only create miracles of wealth but also open a new chapter in human cognition. Navigating in the ocean of data, Simons is that lighthouse that illuminates a new channel leading to the future.