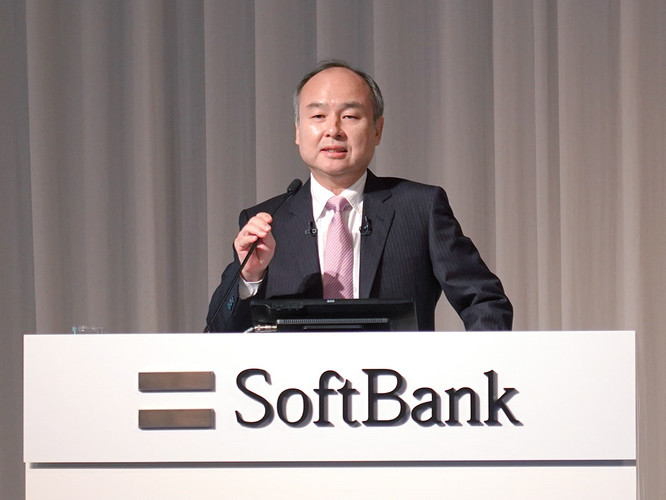

In a morning in Tokyo, as the sun was just rising, a tall man stood by the office window, gazing into the future of the city. He is Masayoshi Son, an entrepreneur with extraordinary foresight and the founder of SoftBank Group. He often says, "I think about what will happen in ten years every day." This statement not only reflects his profound insight into the future but also indicates how he will continue to reshape the landscape of the technology industry.

I. The Germination of Dreams in Youth

Masayoshi Son was born into an ordinary family, but he demonstrated distinctive business acumen and an adventurous spirit from an early age. While his peers were still playing and frolicking, he had already begun to try various small businesses, such as selling self-made trinkets and running errands for neighbors to earn pocket money. These seemingly insignificant experiences planted the seed of entrepreneurship in his heart.

"I'm not a genius. I just work harder than others." This famous quote of Masayoshi Son is a true reflection of his early spirit of struggle.

To pursue broader knowledge and opportunities, Masayoshi Son resolutely embarked on the journey to study in the United States. When he first arrived in the United States, he faced numerous difficulties such as language barriers and huge cultural differences. However, he was not intimidated by these challenges. Instead, with tenacious perseverance and diligent study, he quickly adapted to the new environment.

During his college years, Masayoshi Son not only achieved excellent academic results but also actively participated in various social practice activities. He once participated in an innovative project on electronic technology. Through the unremitting efforts of the team members, he successfully developed a prototype of a new electronic device. Although this project did not immediately bring huge commercial success, it accumulated valuable technical experience and innovative thinking for him.

Data shows that during his college years, Masayoshi Son's GPA always remained above 3.8, and he also won multiple academic awards and honors. Behind these achievements are countless days and nights of his hard study and research.

During his study in the United States, Masayoshi Son keenly sensed the huge potential of the Internet industry. He began to deeply study Internet technology and business models and made a group of like-minded friends and industry experts.

Once, Masayoshi Son attended a seminar on Internet entrepreneurship. At the seminar, he was deeply inspired by an expert's analysis of the future development trend of the Internet. He realized that the Internet would change people's lifestyle and business pattern, so he decided to devote himself to this field full of opportunities.

"I believe that the future belongs to those who dare to dream and innovate." This view of Masayoshi Son has also become the source of power for him to continuously explore and forge ahead in the business field later.

II. Returning to the Homeland with Dreams

After completing his studies and gaining experience in the United States, Masayoshi Son returned to Japan with full enthusiasm and infinite longing for the future. He deeply understood that what he accumulated in the United States was not only knowledge but also an innovative way of thinking and extensive network resources. "I want to build an enterprise with global influence in Japan." This bold statement of Masayoshi Son has become the source of power for his struggle.

He keenly sensed that Japan was in a period of rapid economic development at that time, and the information technology industry had huge potential waiting to be tapped. With his in-depth understanding of the technology industry in the United States, he firmly believed that he could create his own world in this land.

Masayoshi Son plunged into the wave of entrepreneurship without hesitation and founded SoftBank. However, the road of entrepreneurship has never been smooth. In the early days of SoftBank's establishment, it faced many difficulties such as shortage of funds, lack of talents, and fierce market competition.

To raise funds, Masayoshi Son rushed around, seeking help from relatives and friends, and even mortgaged his own property. It is understood that in the first few months of starting a business, he worked more than 16 hours a day, personally participating in every business link of the company, from product research and development to market promotion, all done by himself.

Despite numerous difficulties, Masayoshi Son never gave up. He firmly believed that as long as he persevered, he would definitely succeed. "Once I make up my mind to become the first, I will actively strive towards this goal. This is my personal work creed." It is this firm belief that supported him through the most difficult period.

III. Resolutely Choosing to Focus on Software Distribution Business

When SoftBank was just starting, Masayoshi Son keenly perceived the huge potential of the software industry. In that era when information technology was quietly emerging, he decisively decided to focus SoftBank's core business on software distribution.

"I believe that software will be the key driving force of the future world." This belief of Masayoshi Son prompted him to devote himself wholeheartedly to the field of software distribution. He deeply understood that to stand out in this highly competitive market, he must have unique strategies and execution power.

Masayoshi Son led the team to look for high-quality software products everywhere and established close cooperation relationships with software developers at home and abroad. He personally went to technologically advanced regions such as the United States to negotiate cooperation matters with local enterprises. Through unremitting efforts, SoftBank gradually accumulated rich software resources.

For example, in the early days, SoftBank successfully reached a cooperation agreement with a small American software company and obtained the exclusive agency right in Japan for one of its innovative office software. Masayoshi Son fully exerted his marketing talents and quickly promoted this software to the Japanese market through large-scale marketing activities. Data shows that within just a few months, the sales volume of this software exceeded several million dollars, bringing substantial profits to SoftBank.

To ensure the smooth development of the software distribution business, Masayoshi Son deeply understood that he must build a strong sales network. He invested a large amount of funds and manpower and set up branches and sales points in various places in Japan.

He recruited a group of salespeople full of passion and innovative spirit and provided them with strict training. Masayoshi Son personally taught sales skills and product knowledge to the salespeople and inspired them to move forward bravely.

At an internal training meeting of the company, Masayoshi Son said, "Our salespeople are not just selling products but also delivering value and innovation." This sentence was deeply engraved in the hearts of every salesperson.

Through continuous expansion and optimization of the sales network, SoftBank's software products could quickly cover every corner of Japan. Whether in the bustling commercial areas of big cities or small enterprises in remote areas, one could see the figures of SoftBank's sales team.

Masayoshi Son understood that in a highly competitive market, having good products alone is not enough; one also needs unique and effective marketing strategies.

He boldly adopted a variety of innovative marketing methods. For example, he held large-scale software exhibitions and seminars, invited industry experts and customers to participate, and let them experience the advantages of SoftBank's software products firsthand. At the same time, Masayoshi Son also actively used media and advertising to increase the brand awareness of SoftBank.

At a software exhibition, SoftBank displayed a brand-new graphic design software. Masayoshi Son personally demonstrated the powerful functions of this software on the stage, attracting the attention of numerous customers. On the spot, dozens of enterprises signed purchase contracts with SoftBank.

In addition, Masayoshi Son also focused on establishing long-term cooperation relationships with customers. He set up a special customer service department to promptly solve the problems encountered by customers during the use of software, winning high trust and praise from customers.

Masayoshi Son deeply understood that talents are the core competitiveness of an enterprise. In the initial stage of SoftBank, he actively recruited all kinds of excellent talents.

He did not hesitate to spend a large sum of money to hire a group of talents with rich industry experience and professional skills to join SoftBank. These talents not only played an important role in technology research and development, marketing, and other aspects but also brought new thinking and innovative concepts to SoftBank.

Masayoshi Son attached great importance to team building. He encouraged employees to cooperate and learn from each other. He often organized team activities to enhance the cohesion and sense of belonging among employees.

Once, when SoftBank was facing a major project, Masayoshi Son summoned the backbone personnel of various departments of the company and formed a temporary project team. Under his leadership, this team successfully completed the project task after continuous weeks of hard work, winning important customers and market share for SoftBank.

The important decisions made by Masayoshi Son in the initial stage of SoftBank laid a solid foundation for the subsequent development of SoftBank. His courage, wisdom, and innovative spirit are worthy of learning and reference for every entrepreneur and businessperson.

Through focusing on software distribution business, Masayoshi Son successfully found the core competitiveness of SoftBank. His strong sales network, innovative marketing strategies, and excellent talent team jointly promoted the rapid development of SoftBank.

In today's highly competitive business environment, we can draw valuable lessons from Masayoshi Son's experience. Whether it is the keen insight into market trends, decisive decision-making, or firm execution power, they are all key factors for achieving success.

As Masayoshi Son said, "What I have to do is to become one of the largest companies in the world in the next few decades." His lofty aspiration and firm belief will continue to inspire SoftBank and countless entrepreneurs to keep moving forward and create more brilliant business achievements.

IV. The Wealth Code Behind Alibaba

Back in the eventful year of 2000 when the Internet wave was just beginning to sweep across the globe. At that time, Alibaba was just a small company struggling on the road of entrepreneurship, but it had unlimited potential and possibilities.

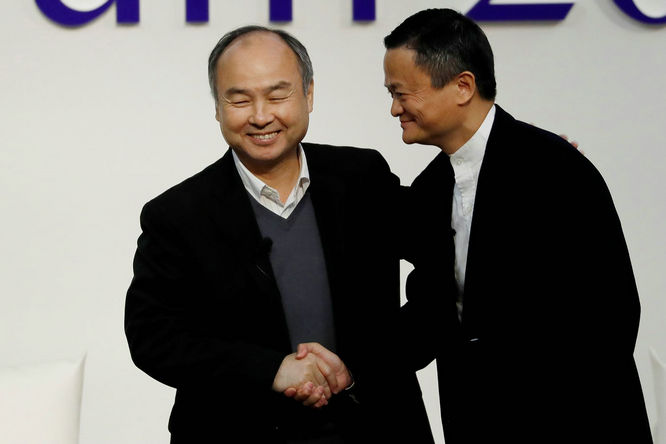

Masayoshi Son, an investment master known for his keen business sense, heard about the story of Alibaba by chance. He was immediately attracted by Alibaba's unique business model and the passion and ambition of its founder Jack Ma. "When I first met Jack Ma, I knew he was a distinctive person. His eyes were shining with firm belief in the future." Masayoshi Son once recalled this.

Therefore, Masayoshi Son resolutely decided to invest in Alibaba. Without hesitation, he took out 20 million US dollars and injected it into this promising young company. This sum of money was like a timely rain for Alibaba at that time, providing strong impetus for its subsequent development.

The reason why Masayoshi Son dared to make such a large-scale investment in Alibaba at that time was not just a momentary impulse. He had gone through in-depth research and analysis.

First of all, he saw the huge potential of the Chinese Internet market. At that time, China was in a stage of rapid economic development. Although the popularity of the Internet was not high yet, the growth rate was extremely astonishing. Masayoshi Son firmly believed that China would become one of the largest Internet markets in the world.

Secondly, Alibaba's business model is highly innovative. The B2B e-commerce model proposed by Jack Ma aims to build a globalized trading platform for small and medium-sized enterprises. This model not only can solve many problems faced by small and medium-sized enterprises in traditional trade but also has great expansion space.

Furthermore, Masayoshi Son highly admires the abilities and hardworking spirit of Jack Ma and his team. Jack Ma has excellent leadership skills and keen market insight, and his team is also full of passion and creativity. Masayoshi Son deeply knows that an excellent team is the key to the success of an enterprise.

With the help of Masayoshi Son's investment, Alibaba began to develop rapidly.

Alibaba has continuously expanded its business fields, gradually evolving from an initial B2B e-commerce platform into a comprehensive Internet giant covering B2C, C2C, fintech, logistics, and other multiple fields. Its platforms such as Taobao and Tmall have become an indispensable part of Chinese consumers' daily lives.

Data shows that the market value of Alibaba has achieved thousands of times growth in the past few decades. And the 20 million US dollars investment by Masayoshi Son initially also obtained astonishing returns. It is estimated that the value of Masayoshi Son's holdings in Alibaba reached as high as several billion US dollars at its peak.

For example, when Alibaba went public in the United States in 2014, it became the focus of global attention. This listing not only raised a huge amount of funds for Alibaba but also brought Masayoshi Son's investment returns to a new height.

This successful investment case of Masayoshi Son contains rich investment philosophies and inspirations.

"I only invest in companies that can change the world." This famous quote of Masayoshi Son fully reflects his investment concept. He always adheres to looking for enterprises with innovative abilities and huge development potential and dares to make bold investments in the early stage.

At the same time, Masayoshi Son attaches great importance to the value of long-term investment. He will not easily sell his holdings due to short-term market fluctuations but patiently waits for the growth and development of the enterprise.

For entrepreneurs and investors, the story of Masayoshi Son and Alibaba is an extremely inspiring example. It tells us that we must dare to pursue our dreams, have keen market insight and decisive decision-making abilities, and learn to persevere and wait patiently.

V. The Rise of WeWork and SoftBank's Big Bet

WeWork once rapidly expanded globally with its innovative shared office model, attracting the attention of countless people. Masayoshi Son immediately saw its potential and firmly believed that this is an enterprise that can change the future way of working.

"I am always looking for companies that can subvert traditions. WeWork undoubtedly has such characteristics." With this belief, Masayoshi Son began to closely cooperate with WeWork. SoftBank has successively invested a huge amount of funds in WeWork. According to statistics, the investment of SoftBank and its Vision Fund in WeWork is as high as several billion US dollars.

With the help of funds, WeWork embarked on a crazy expansion path. It quickly opened new office locations in major cities around the world, and the number of employees also increased sharply. For a time, WeWork became a star enterprise in the technology startup field, and its valuation kept soaring.

However, the good times didn't last long. As time went by, various problems within WeWork began to gradually emerge.

First of all, WeWork's business model has serious defects. Although the shared office concept is novel, the profit model is not clear. WeWork mainly relies on collecting rent and providing value-added services to obtain income, but the high operating costs and fierce market competition make its profitability extremely limited. For example, in some cities, WeWork does not hesitate to lease properties at high prices to compete for market share, resulting in excessive rent costs. In terms of value-added services, although a series of projects such as enterprise services and community activities have been launched, the actual revenue is far lower than expected.

Secondly, the company's management is in a mess. The founder of WeWork, Adam Neumann, has been accused of a series of improper behaviors, including using company funds for personal consumption and having family members hold important positions in the company but lacking corresponding abilities. The internal decision-making process is not clear, and the collaboration between various departments is difficult, resulting in low operational efficiency of the company.

Furthermore, changes in the market environment have also dealt a heavy blow to WeWork. With the slowdown of global economic growth, the demand for office space from enterprises has decreased. At the same time, competitors continue to emerge, and WeWork's market share is gradually being squeezed.

Overly optimistic valuation judgment

When Masayoshi Son and his team were investing in WeWork, they overestimated its future development potential and market value. They were deceived by WeWork's early rapid expansion and superficial prosperity and did not deeply analyze the sustainability and potential risks of its business model. "Sometimes I rely too much on my intuition and ignore some details." Masayoshi Son admitted this in his reflection.

Lack of effective supervision of the founder

After investing in WeWork, SoftBank did not conduct effective supervision and restraint on Neumann, the founder of WeWork. Neumann had excessive power in the company, enabling him to make decisions casually and even put personal interests before the company's interests. SoftBank did not discover and correct these problems in time, ultimately leading to the loss of control of the situation.

Insufficient industry research

Before investing in WeWork, although SoftBank saw the development potential of the shared office industry, its in-depth research on this industry was not enough. They did not fully understand the intensity of competition, the complexity of the profit model, and the uncertainty of market demand in the shared office industry. This makes them unable to make correct decisions in time when facing problems.

More cautious valuation methods

"In the future, I will pay more attention to analyzing the fundamentals of enterprises and no longer rely solely on the imagination space of the future for valuation." Masayoshi Son said. He realizes that when making investment decisions, it is necessary to conduct comprehensive and in-depth research on aspects such as the financial status, profitability, and market competitiveness of enterprises to ensure the rationality of the investment.

Strengthening the management and supervision of invested enterprises

SoftBank will strengthen the construction of the management and supervision mechanism of invested enterprises. They will send professional management personnel into the invested enterprises to participate in the company's major decisions to ensure that the operation of the company complies with regulations and the interests of shareholders. At the same time, a stricter risk warning mechanism will be established to discover and solve problems in time.

In-depth industry research and trend judgment

Masayoshi Son realizes that only by having in-depth understanding of an industry can one make correct investment decisions. He will increase investment in the industry research team and require them to conduct comprehensive and in-depth analysis of each investment field, including market size, competition pattern, and technological development trends. So that before investing, they can accurately grasp the development trends and potential risks of the industry.

Masayoshi Son's failure in investing in WeWork, although bringing huge losses to him and SoftBank, has also become a valuable lesson. This incident reminds every investor and entrepreneur that in business decisions, they cannot be deceived by superficial prosperity and must maintain a calm mind and keen insight.

"Failure is the mother of success. I will draw strength from this failure and continue to move forward." This sentence of Masayoshi Son shows his indomitable spirit. It is believed that in his future investment career, he will create new glories with a more cautious and mature attitude. And for each of us, Masayoshi Son's experience also provides a profound warning: on the road to pursuing success, we must always be vigilant, continuously learn and reflect to avoid repeating the same mistakes.

VI. Vision Fund: A Transforming Force in the Tech Field

With the rapid development of global technology, emerging technologies such as artificial intelligence, big data, and the Internet of Things are constantly emerging and are profoundly changing people's lifestyles and work methods. Masayoshi Son keenly sensed this historical opportunity and firmly believes that technology will be the core driving force of the future world.

"I believe that the future information revolution will start from places we can't imagine now." This belief of Masayoshi Son prompted him to decide to establish the Vision Fund. At that time, although there were numerous venture capital institutions active in the tech field, Masayoshi Son believed that their investment scale and influence were far from sufficient to promote the rapid transformation of the entire tech industry.

In addition, Masayoshi Son has accumulated rich experience and resources in his past investment career. He is eager to integrate these resources through a larger investment platform to provide strong support for global tech innovation enterprises. At the same time, the global capital market has also shown strong interest in investments in the tech field, and a large amount of funds are looking for tech projects with high growth potential. Against this background, the Vision Fund came into being.

Once established, the Vision Fund shocked the entire investment world with its huge fund size. According to statistics, the first phase of the Vision Fund raised as much as tens of billions of dollars, becoming one of the largest private equity investment funds in the world.

Masayoshi Son adopted a unique investment model. He is not bound by traditional venture capital strategies but dares to make large-scale investments in potential tech enterprises in a short period. This investment method not only provides sufficient financial support for enterprises but also helps them rapidly expand their scale and seize market share.

For example, the Vision Fund's investment in the Indian e-commerce platform Flipkart. Within just a few years, the Vision Fund has injected billions of dollars into Flipkart successively. This huge sum of money enabled Flipkart to rapidly expand in the Indian market and engage in fierce competition with competitors. Eventually, Flipkart became one of the leading enterprises in the Indian e-commerce field.

Accelerating the Development of Tech Innovation Enterprises

The emergence of the Vision Fund has provided much-needed financial support for numerous tech innovation enterprises, helping them achieve rapid transformation from ideas to commercialization. Many enterprises that might have been unable to grow and develop due to lack of funds originally have been able to rise rapidly with the assistance of the Vision Fund.

Taking the self-driving technology company Cruise as an example, the investment of the Vision Fund has enabled Cruise to increase investment in technology research and development, talent recruitment, and market promotion. Today, Cruise has become one of the important players in the global self-driving field, and its technical level and market influence are constantly improving.

Promoting Changes in Industry Integration and the Competitive Landscape

The large-scale investment behavior of the Vision Fund has also triggered an integration wave in the tech industry. By investing in multiple enterprises of the same type, the Vision Fund prompts cooperation or mergers among these enterprises, thereby improving the concentration and competitiveness of the industry.

In the shared mobility field, the Vision Fund has invested in multiple ride-hailing companies and related tech enterprises. Under the promotion of the Vision Fund, these enterprises have begun to integrate resources and collaborate on business, changing the traditional travel market pattern.

Leading the Transformation of Investment Concepts

Masayoshi Son and the investment style and concepts of the Vision Fund have had a profound impact on the entire venture capital industry. They dare to make bold investments in early-stage tech enterprises, focus on creating long-term value instead of just focusing on short-term financial returns.

The spread of this investment concept has prompted more investment institutions to start paying attention to the tech innovation field and be willing to provide long-term financial support for enterprises with innovation and high growth potential.

However, the development of the Vision Fund is not all smooth sailing. On the one hand, due to its large-scale investments and aggressive investment strategies, the Vision Fund also faces relatively high risks. Some invested enterprises may encounter various problems during their development process, such as technical difficulties, market changes, and poor management, which may all lead to investment returns falling short of expectations.

For example, WeWork was originally regarded as a star enterprise in the shared office field but encountered a series of problems on the eve of going public, including doubts about its business model and chaos in corporate governance, resulting in a significant shrinkage of its valuation. The investment of the Vision Fund in WeWork also suffered significant losses.

On the other hand, the large-scale investment behavior of the Vision Fund has also triggered some controversies. Some people believe that the investment of the Vision Fund may lead to overheated development in certain industries, triggering bubble risks. At the same time, its strong financial strength may also cause unfair competition pressure on some small investment institutions and entrepreneurs.

Masayoshi Son's Vision Fund is undoubtedly a powerful force in the tech field. Its establishment and development have brought new opportunities and challenges to global tech innovation enterprises. Although facing many difficulties and controversies, the contributions made by the Vision Fund in promoting the development of the tech industry cannot be ignored.

"I am willing to take risks for the future technological revolution because I believe it is worth it." This sentence of Masayoshi Son fully reflects his firm belief in the Vision Fund and his infinite longing for the future of technology.

In the future, with the continuous progress of technology and the continuous development of the global economy, the Vision Fund will continue to play an important role. It will continue to look for tech enterprises with innovation and high growth potential, provide them with financial and resource support, and promote continuous innovation and transformation in the tech industry.

At the same time, the Vision Fund also needs to continuously summarize experience and lessons, optimize investment strategies, and improve risk management capabilities to cope with the increasingly complex market environment. It is believed that under the leadership of Masayoshi Son, the Vision Fund will continue to write its own glorious chapter and make greater contributions to the development of global technology.