In the glittering constellation of Silicon Valley titans, each luminary conceals an untold tale, with Eduardo Eduardo Saverin name intertwined in a complex, profound narrative that shadows Facebook's meteoric rise. As one of Facebook’s co-founders, Eduardo Saverin journey transcends a mere fusion of technology and commerce; it’s a chronicle of friendship, betrayal, rebirth, and reconciliation.

The Spark of a Dream

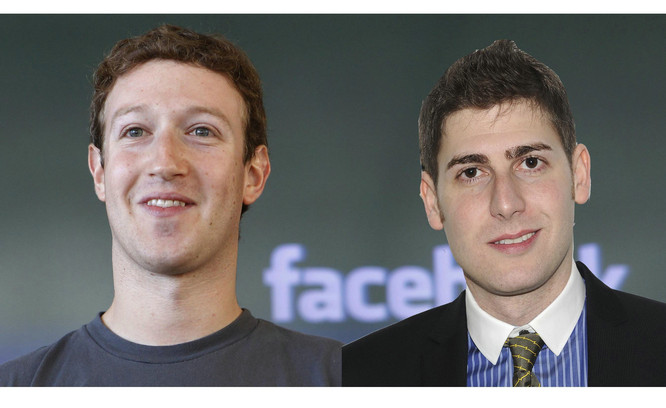

Rewind to 2004, on a spring afternoon when most students were engrossed in books at the library, Saverin and his friend Mark Zuckerberg fervently discussed an audacious idea within the confines of their dorm room—an online platform connecting Harvard students. This concept would evolve into the world-stirring Facebook. Recognizing the boundless potential of this vision, Saverin promptly committed $15,000 as seed capital, a princely sum for any student. His philosophy, "Investing in the future is investing in ourselves," embodied the courage and foresight that fueled Facebook's initial ascent.

Diverging from conventional social norms, Facebook harnessed data from its inception, evolving beyond a networking platform to a smart network powered by user behavior and preferences. Saverin, acutely aware of data’s worth, worked alongside his team to leverage this information, enhancing user experience, and propelling Facebook’s popularity across Harvard within months, later expanding to other universities, and eventually, globally. By the end of 2004, Facebook boasted over a million registered users, a near-unprecedented growth rate.

The Turning Point: Fractures and Growth

With his astute business sense and financial background, Saverin facilitated Facebook's rapid expansion from Harvard to campuses nationwide, witnessing exponential user growth. His impact transcended financial contributions, laying crucial groundwork in legal frameworks and advertising partnerships that paved the way for commercial success. Saverin stressed, "Innovation necessitates not just ideas but the execution to make them real." His words encapsulated his pivotal early role at Facebook.

However, as Facebook’s star ascended, Saverin found himself amidst an unforeseen tempest. In 2005, corporate restructuring and disagreements with co-founders led to a substantial dilution of his shares, a drama later immortalized in the film 'The Social Network.' While the public perceived this as a tale of power struggles and broken trust, for Saverin, it was a crucible. He maintained remarkable composure, asserting, "Adversity often reveals our true selves."

Crucially, 2005 marked Saverin's decision to move past these events, focusing on new horizons. Gradually disengaging from Facebook's daily operations, he turned his attention to fresh business prospects and investment arenas. Amidst speculative chatter about his Facebook ties, Saverin quietly accumulated strength, preparing for his next transformation. His actions exemplified the resilience and forward-thinking essence of entrepreneurship, echoing his sentiment, "True success stems from learning from every failure and moving ahead with renewed determination."

Rebirth: Surpassing Limits and Reconciliation

Departing Facebook marked both an end and a new beginning for Saverin. Unburdened by past triumphs or regrets, he swiftly redirected his path towards venture capitalism. Leveraging Facebook experiences and his market acuity, Saverin set his sights on Asia, particularly Singapore, a hub teeming with technological innovation. His investments spanned fintech, e-commerce, healthcare, and more, nurturing rising stars like Juno and 99.co. In a few short years, companies under his patronage saw their valuations multiply several fold, affirming not only his investment prowess but also his personal triumph over adversity and self-transcendence.

Data-Driven Wisdom in Investment: Saverin's Approach

Eduardo Saverin's investment philosophy, deeply influenced by his time at Facebook, underscores the power of data. He once remarked, "Amidst the deluge of information, what truly holds value are the data points that guide us in forecasting the future." This forward-thinking mindset propels him to mine vast datasets first, uncovering nascent market trends and consumer needs before making investment decisions.

Take, for instance, his ventures in fintech, where he backed companies such as Stripe, a payment solutions provider, and Coinbase, a cryptocurrency exchange. Over subsequent years, these firms experienced substantial valuation hikes. Coinbase, notably, listed in 2021 with an over $85 billion valuation, marking a multiple increase since Saverin's initial investment. By meticulously examining blockchain's growth trajectory, user expansion data, and market receptivity, Saverin made a prescient investment call.

In healthcare, Saverin demonstrated similar analytical prowess, investing in 23andMe, a genomics-focused company leveraging big data to provide personalized medical services based on individual genetic profiles. This investment not only reflected his profound understanding of life sciences but also accurately predicted the potential of data in personalized medicine. With declining costs of gene sequencing and increasing demand for personalized healthcare, 23andMe witnessed rapid growth in its user base and market value.

He also ventured into sustainable energy, backing firms like Aurora Solar, which optimizes solar system deployment through sophisticated software. Amid soaring global demand for renewable energy, Aurora Solar rapidly expanded, becoming a sector leader. Eduardo Saverin accurate anticipation of the sector's immense potential was grounded in analyzing energy consumption patterns, policy directives, and technological advancements.

The success of Saverin's strategy owes not solely to his deft handling of data but also to integrating data insights with a profound grasp of human needs and societal trends. He believes, "Data forms the skeleton, while human needs and emotions provide the flesh; together, they create products with vitality." Hence, he meticulously evaluates teams' creativity, execution capability, and sensitivity to user needs—qualitative aspects that significantly contribute to his investment choices.

Conclusion: Transcending Controversy, Embracing the Future

Saverin's story is a profound testament to growth amidst adversity. From Facebook co-founder to a distinguished independent investor, he has shown how challenges can be transformed into opportunities and how grace and foresight can prevail in controversy. His words ring true: "Real success lies in continuous learning, adaptation, and innovation." Saverin's journey serves as a living textbook in the ever-changing tech landscape, reminding dream-chasers that every stumble on the entrepreneurial path paves the way forward.

His tale offers profound lessons to all entrepreneurs—that regardless of obstacles, staying true to one's convictions and fearlessly exploring can lead to crafting a unique legacy within one's chosen field. Saverin embodies the spirit that, in the pursuit of innovation, every setback is but a stepping stone to triumph.